Everything you need to manage your 401(k)

Comprehensive features designed for modern plan administration.

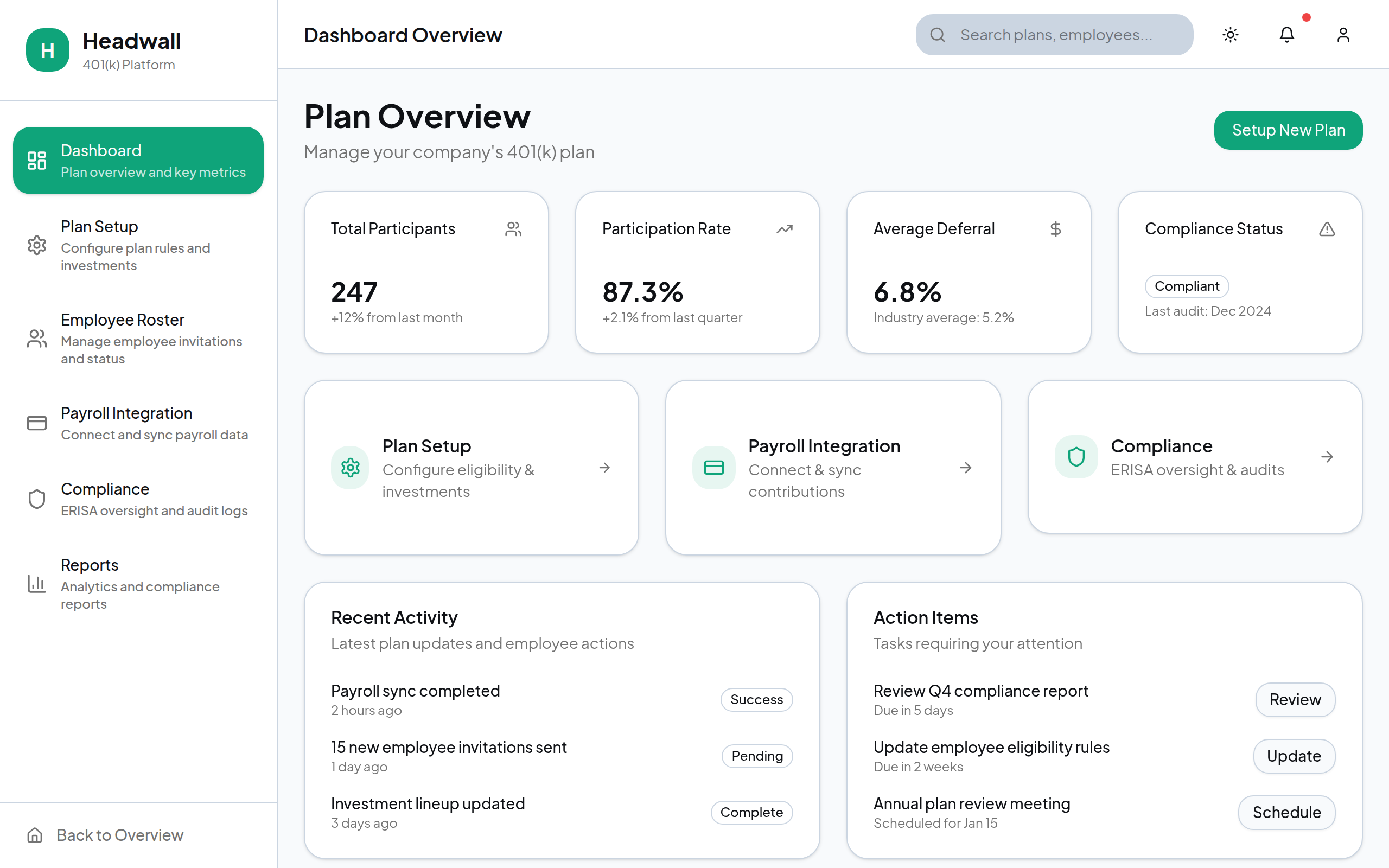

Plan Setup & Configuration

Configure eligibility rules, employer matching formulas, and contribution types with guided setup.

- Flexible eligibility requirements

- 5,000+ permitted investments for Investment Lineup

- Traditional and Roth options

Payroll Integration

Connect with major payroll providers for automated contribution processing and real-time sync.

- ADP, Paychex, and more

- Automated daily sync

- API and file upload options

ERISA Compliance

Built-in compliance monitoring with automated audit trails and fiduciary responsibility tracking.

- Fiduciary duty monitoring

- Automated audit logs

- Quarterly compliance reports

Analytics & Reporting

Comprehensive analytics with participation trends, contribution analysis, and performance metrics.

- Real-time participation tracking

- Plan asset growth analysis

- Demographics and trends

The problems with legacy 401(k) providers

Poor user experience

Outdated interfaces and confusing investment options lead to low employee engagement and poor retirement outcomes.

High administrative burden

Manual processes, complex compliance requirements, and constant vendor management consume HR resources.

Hidden fees and complexity

Opaque fee structures and limited investment options prevent employees from optimizing their retirement savings.

Proven results for plan sponsors

See the impact of modern 401(k) administration on key plan metrics.

87.3%

Average Participation Rate

Higher than industry average of 83%, driven by intuitive user experience and AI-powered guidance.

6.8%

Average Deferral Rate

Above industry benchmark of 5.2%, with personalized recommendations increasing contribution rates.

100%

Compliance Rate

Automated compliance monitoring and built-in ERISA oversight ensure continuous regulatory adherence.

Simple, transparent pricing

No setup fees, no hidden costs, no surprises.

Platform Fee

Paid by employer, covers all platform costs

Contact for pricing

Based on plan size and features. Includes setup, maintenance, compliance, and support.

Self-directed trading (free for participants)

AI-powered personalized models (5-50 bps for participants)

Automated compliance and reporting

Payroll integration and support